Articles

A confidence manager can be identify as numerous beneficiaries because they such; however, to own deposit insurance policies aim, a rely on account manager one describes five or even more qualified beneficiaries will never be insured beyond $step 1,250,000 for each and every lender. Within the calculating publicity, a recipient simply counts immediately after for each manager, even if the same recipient is roofed several times to your believe profile at the same bank. The bill away from a combined Membership can also be exceed $250,one hundred thousand and still getting totally covered. This example takes on that the a couple co-residents have no other joint account during the lender (sometimes with her or that have all other somebody). The new FDIC contributes along with her the places within the old age membership in the list above belonging to a comparable people at the same insured lender and you can ensures the total amount up to a maximum of $250,000.

- The brand new Irs prompts taxpayers to file because of the April 15 government income tax deadline and pick head deposit for people refund it can be owed.

- Withholding representatives should be have fun with specified section 4 position requirements on the Versions 1042-S to own payments produced.

- More 50 analysis points felt for every bank, credit relationship and you will banking tech company (or neobank) as entitled to all of our roundups.

- Research revenue always been the key rider of one’s increase, incorporating $step 3.2 billion to your DIF equilibrium.

- Morgan Advanced Put are susceptible to eligibility standards in addition to however simply for account type, very first lowest put standards and you will harmony maximums.

The new UFB Head Freedom Checking and you can Offers package topped our list while the best take into account Automatic teller machine availability. Whether or not UFB Lead are an online-simply bank, it’s a comprehensive percentage-totally free Automatic teller machine community of approximately 91,100000 urban centers all over the country, enabling you to easily withdraw funds from your bank account. Consider this to be membership if you need digital financial, prioritize reduced costs and you can accessible customer care, and want one of the large production on the market.

Online casino real money no deposit Play Club | Processing Variations 941, Mode 943, Function 944, otherwise Form 945

Your employer will get curently have particular information on HSA trustees in the your area. Visit Irs.gov/Variations to help you down load latest and earlier-season variations, recommendations, and you can publications. The new consent automatically expires 12 months regarding the due date (without any extensions) to have filing the 2024 Setting 1042. For many who or your own designee desires to terminate the brand new authorization, an authored statement conveying your wish to revoke the fresh consent is always to be submitted to the new Irs provider heart in which the come back is canned. How to proceed for many who overwithheld tax relies on after you discover overwithholding.

Why Top Financial?

Although not, there are many brokerage firms that set the new bar lower — such as, offering an advantage simply for setting online casino real money no deposit Play Club very first exchange. It actually was £661 to buy scams, typically the most popular type of fraud, where scammers create consumers purchase something or a service it never discover. That is based on United kingdom Financing, a trade relationship to the British financial community, which details the brand new times claimed because of the the professionals.

As a whole, extent you ought to were ‘s the amount where the brand new FMV of one’s work with is over the sum exactly what the new personnel paid for it as well as one matter the law excludes. There are other unique legislation both you and your team can use to help you really worth certain edge advantages. The earnings on the services of people who works for the companion in the a swap otherwise organization are at the mercy of money tax withholding and social protection and Medicare taxes, although not so you can FUTA taxation. However, the newest money to have characteristics of a single companion utilized by some other inside apart from a swap or business, such as domestic service inside the a private home, are not subject to personal security, Medicare, and you can FUTA taxation. If these types of repayments is actually to own performs besides in the a swap otherwise organization, including residential are employed in the fresh parent’s personal home, they’lso are perhaps not at the mercy of public security and you can Medicare taxation before the son is at decades 21.

An employee just who submits an incorrect Form W-4 is generally at the mercy of a good $five-hundred punishment. You can also eliminate a type W-cuatro as the invalid in case your worker composed “exempt” below Step(c) and you can searched the container in the Step two(c) or joined quantity to possess Procedures step 3 and 4. For additional information regarding the workplace withholding conformity, see Irs.gov/WHC. Withholding for the extra wages whenever a member of staff get more $1 million from extra wages from you inside the calendar year. When the an employee account for your requirements on paper $20 or maybe more away from tips in 30 days, the tips are at the mercy of FUTA taxation. Noncash wages, along with commodity earnings, paid back to farmworkers.

- You ought to dictate when to put the tax based on the level of their quarterly taxation accountability.

- Always be sure the newest EIN to the setting your document exactly fits the new EIN the fresh Irs assigned to your business.

- Devote some time to shop to and you may think about what’s most significant.

- Most subscription techniques are pretty straight forward – fill in very first advice, manage a safe password, and voila!

- This lady has more than a decade of expertise writing and you can modifying to own user websites.

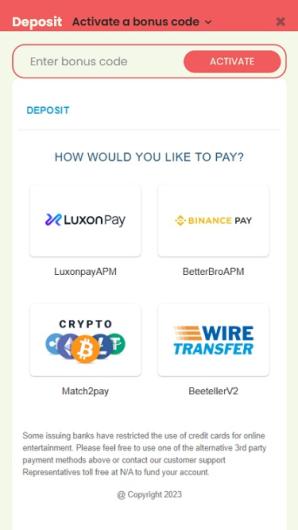

Keep in mind that even if quick verification isn’t required, most casinos on the internet will need it prior to making a bona fide money deposit or buy gold coins to help you receive some thing. It’s best if you make this step out of the brand new means early to avoid one hiccups later on. The casino sites provide some kind of extra to attract the fresh and you may hold current consumers. There are many strategy categories – sign-upwards also provides, more income, free spins, cashback, suggestion applications, and you will commitment techniques.

Because the Dollars Application try an economic functions program rather than a great financial, dumps is actually FDIC-insured due to Wells Fargo Bank for as much as $250,one hundred thousand for every person. The fresh greeting bonus usually has suits incentives (a share increase on your own basic deposit) as well as totally free spins to understand more about common ports. Casinos such Ignition and you can Crazy Local casino are known for the generous welcome bundles, and therefore significantly boosts your own undertaking bankroll.

Care for no less than $15,100 from the checking account to have ninety days just after opening your profile. When you done all criteria for membership, you’ll have the $900 extra in this 15 weeks. Once you’re also signed up for the deal, you’ve got forty-five months in order to deposit $250,one hundred thousand within the the brand new currency otherwise ties into the qualified Chase account. So it incentive isn’t attainable for many people, because it means a deposit out of $250,100. As well as, you’ll become recharged a fee every month out of $thirty-five throughout the one declaration period which you either wear’t features an average harmony out of $150,100000 on the qualified account, or if you don’t have a linked Pursue Rare metal Business Bank account. Once you’re signed up for the deal, you’ve got forty-five months so you can put $500,one hundred thousand in the the new currency or ties into the eligible Chase profile.

Submitting more than one return can lead to control waits and may require interaction between you and the fresh Internal revenue service. To own information on to make adjustments in order to previously submitted output, find part 13. If you discovered composed alerts which you qualify for the shape 944 system, you should document Form 944 as opposed to Forms 941. You should document Setting 944 even if you do not have taxes to help you statement (or if you provides taxes over $step one,100 in order to declaration) unless you recorded a last go back on the prior season. For those who obtained notification so you can file Mode 944, but like to file Forms 941, you can request to own your submitting demands converted to Variations 941 within the very first schedule quarter of the taxation season.

For more information, see just what if you fail to shell out completely, after. To guard covered depositors, the FDIC reacts instantaneously whenever a bank otherwise discounts relationship goes wrong. If the various other financial acquires the new dumps of your own failed lender, users of one’s were not successful bank instantly be people of the obtaining institution.

Suggestions to select the right Computer game term and you may speed

Flagstar Lender features a marketing on the examining profile also it’s relatively easy to complete, as long as you live in the solution area of AZ, Ca, Florida, Within the, MI, New jersey, Ny, OH, or WI. The fresh account provides a $twenty five minimum beginning put there are no month-to-month solution fees. They also reimburse as much as $ten inside the Automatic teller machine costs per report cycle, a nice little brighten.

Offers lasts any where from months so you can ages, however they are always held in order to a particular schedule. The newest 5th 3rd Popular Dollars/Straight back Card offers cardholders an unlimited 2% money back on each buy you will be making with the card. Keep in mind that the fresh account will need to sit unlock for around 6 months to avoid early closure charge. Eastern Financial offers an advantage so you can the brand new East Declaration Deals people. That is a new extra that individuals haven’t seen and you may advantages you for deposit the newest money during the East Lender.